The consensus on michigan solar power rebates and incentives.

Michigan solar incentives 2019.

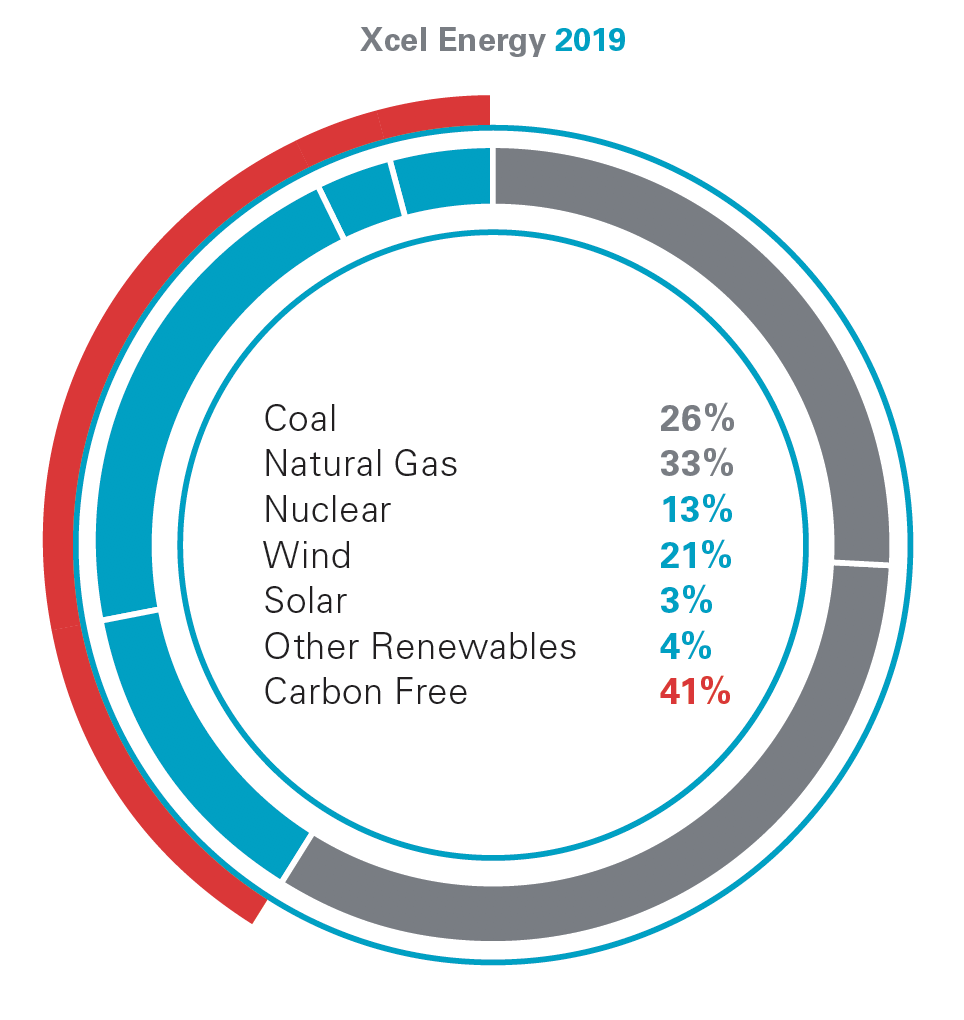

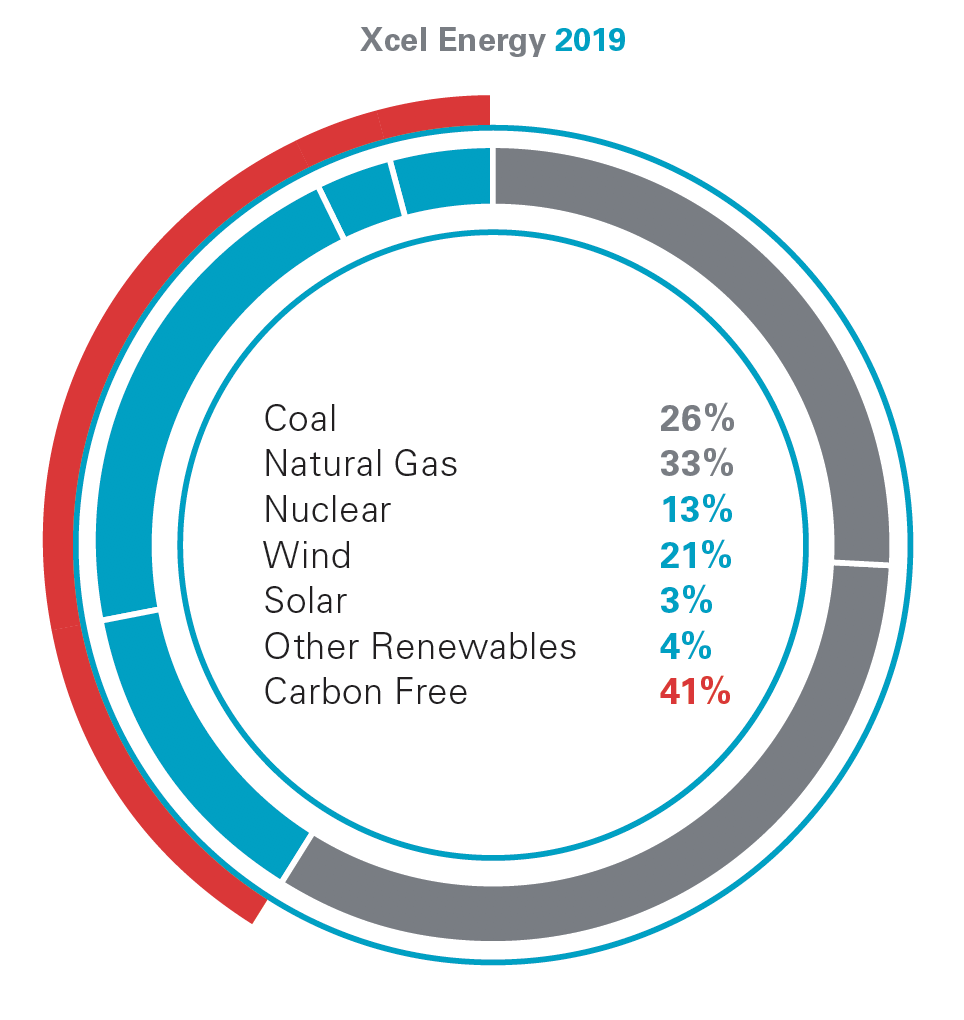

The majority of michigan s electricity comes from coal fired plants and nuclear power.

States for solar irradiance michigan mostly lies farther south than germany where solar power is heavily deployed.

However michiganders can still take advantage of the federal solar tax credit which is worth 30 percent of the total cost of the solar energy system.

Solar power in michigan has been growing in recent years due to new technological improvements falling solar prices and a variety of regulatory actions and financial incentives particularly a 30 federal tax credit available for any size project.

Michigan has a chance to be a great state for home solar power but without net metering it just can t be.

This awesome credit cuts the cost of your overall solar installation by 26 percent making solar pv a more affordable and appealing energy source than fossil fuels.

The value of the credit for wind steps down in 2017 2018 and 2019.

Following the national extension of the solar investment tax credit itc through 2021 it has never been a better time to go solar.

Currently michigan doesn t offer much in terms of solar incentives.

In addition the federal government offers a 30 tax credit for the whole installed cost of your system that s a huge benefit available to you no matter where you live in the us.

As of september 2020 the average solar panel cost in michigan is 3 17 w given a solar panel system size of 5 kilowatts kw an average solar installation in michigan ranges in cost from 13 472 to 18 228 with the average gross price for solar in michigan coming in at 15 850 after accounting for the 26 federal investment tax credit itc and other state and local solar incentives the.

The decision upends the economics of rooftop solar as michiganders are increasingly generating their own power.

See all our solar incentives by state.

Maybe the lawmakers in lansing will come to their senses soon and get net metering back as the law of the land but until then we d recommend extreme caution before.

All of michigan can take advantage of the 26.

2018 can qualify for this credit.

There are two tax credits you need to be aware of when switching to solar.

Here are some of the top solar energy incentives and rebates currently available in michigan.

Michigan also has substantial natural gas reserves and this fossil fuel accounts for more energy usage than any other single source.

See below for more information.

For all other technologies the credit is not available for systems whose construction commenced after december 31 2017.

Michigan ranks thirty second in the nation for solar capacity but installations were up by 33 in 2014.

Michigan solar tax credits and incentive programs the federal investment tax credit.

Federal investment tax credit with the solar investment tax credit you can reclaim about 26 percent of the purchase and installation cost of your solar power system as a federal tax credit.